By making the stock market the only game in town, the Powers That Be can no longer afford to let it decline for any reason.

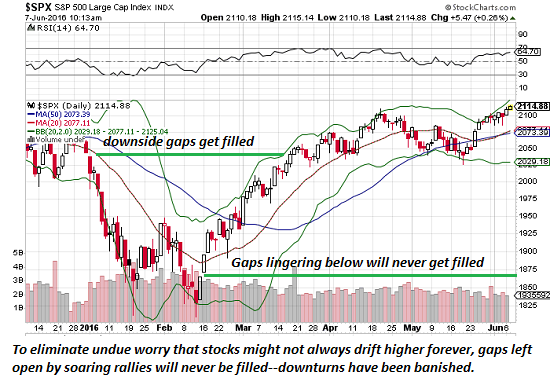

Market technicians have long observed that the holes in charts left when markets gap up or down at the open of trading almost inevitably get filled later on. When the market gaps down, it will eventually rise to fill that gap. When the market gaps up, it will eventually decline to fill that open gap.

Since there are open gaps galore lurking in the lower depths of the S&P 500's chart, that would typically suggest stocks must--gasp!--fall to fill those open gaps. The prospect that stocks might not drift higher forever without interruption is deeply disturbing, and so the Powers That Be have issued a new edict: unfilled gaps below must never be allowed to fill.

This new rule simplifies trading, confidence and sentiment: Bulls can now relax, knowing that the market will never be allowed to decline. Sentiment can stay pegged at "extreme greed" forever, and there is no longer any need to hedge long positions because markets will only move higher.

Volatility will drift lower because any decline will be mere signal noise, only of interest to high-frequency trading (HFT) machines skimming pennies.

Too much is riding on stocks to let them drift lower. The stock market is not only the critical signaling device that tells the world all is well and everything is getting better every day, in every way, it's also the collateral for all sorts of highly profitable schemes, and the financial foundation of the institutions that are supposed to fund pensions and fulfill insurance redemptions.

And even more important, the stock market is the money machine that enables CEOs and top management to push their stocks higher with buy-backs and then cash out their personal stock options for glorious millions.

By making the stock market the only game in town, the Powers That Be can no longer afford to let it decline for any reason: technical, fundamental, quantitative, it no longer matters--stocks must drift higher forever without disruption.

Should a downside gap open, well then of course it will be filled--sooner rather than later. It's those pesky gaps left by rousing rallies that must be left unfilled forever.

So anyways, the all-clear siren has sounded: everyone can buy, buy, buy in complete safety. Nothing will be allowed to mar the beauty of markets lofting ever higher.

Those open gaps around 2,080 and 2,050--ignore them.

That open gap around 1,870--forget it. It will still be open a century from now.

This is what happens when you strip out volatility and game the system: the system loses all natural resiliency and becomes increasingly brittle and fragile. The only way to make sure it doesn't tremble and shatter into pieces is to guarantee that no decline will be allowed.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Kenneth M. ($50), for your splendidly generous contribution to this site-- I am greatly honored by your support and readership.

|